Business Insurance in and around San Antonio

Calling all small business owners of San Antonio!

This small business insurance is not risky

State Farm Understands Small Businesses.

It takes courage to start your own business, and it also takes courage to admit when you might need a hand. State Farm is here to help with your business insurance needs. With options like business continuity plans, worker's compensation for your employees and a surety or fidelity bond, you can take a deep breath knowing that your small business is properly protected.

Calling all small business owners of San Antonio!

This small business insurance is not risky

Surprisingly Great Insurance

Your company is unique. It's where you earn a living and also how you build a life—for yourself but also for your loved ones, and those who work for you. It’s more than just earning a paycheck or an office. Your business is your life's work. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers many occupations like a piano tuner. State Farm agent Deserae Navarro is ready to help review coverages that fit your business needs. Whether you are a veterinarian, a barber or a psychologist, or your business is a book store, an ice cream shop or a window treatment store. Whatever your do, your State Farm agent can help because our agents are business owners too! Deserae Navarro understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Call Deserae Navarro today, and let's get down to business.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

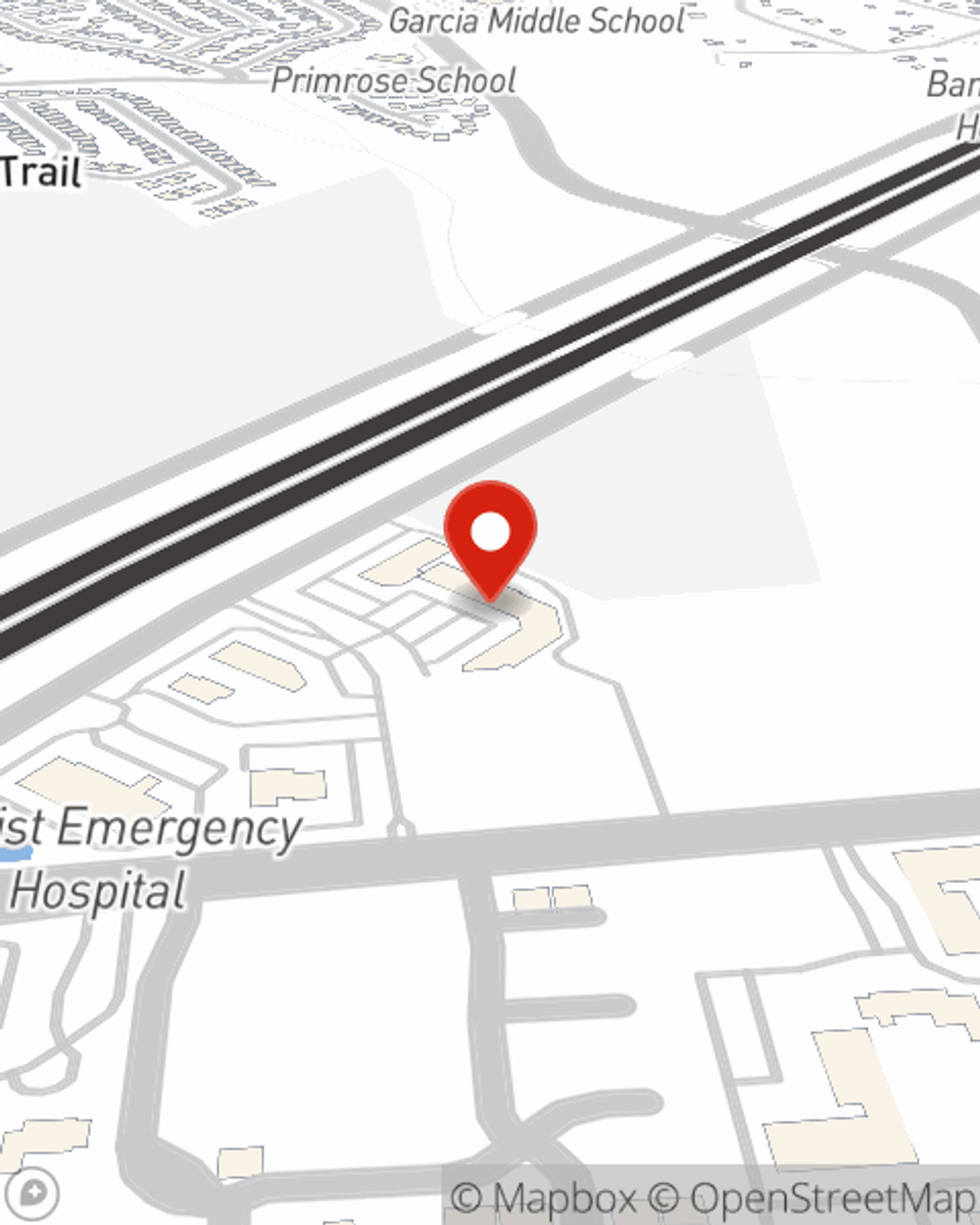

Deserae Navarro

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.